Commbank Deposit Atm

- Customers will be able to deposit a maximum of $10,000 into a CommBank ATM in a single day, down from $20,000. Australia's biggest bank Commbank has today announced it is halving its daily limit.

- Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

- Commbank Deposit Atm Bonus

- Commbank Deposit Atm Chermside

- Commbank Deposit Atm Credit Card

- Commbank Deposit Atm Frankston

Banking Solutions for Study in Australia

Commbank Deposit Atm Bonus

AusStudent is an individual savings account denominated in IDR and AUD for parents who will send their children to continue their study in Australia or for parents who have children who curently are studying in Australia

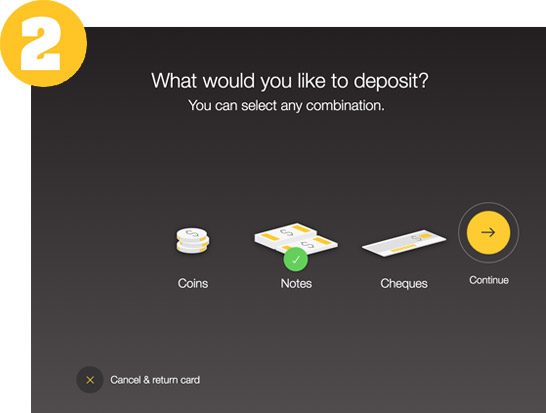

Commonwealth Bank is introducing daily account-based deposit limits at our deposit ATMs as a further measure in our ongoing management of money laundering risks. A new daily account-based deposit limit of $10,000 will apply to CBA personal and business accounts for cash deposits made at CBA deposit ATMs from 10 April 2018. Create your ATM Deposit Code online (only available for business accounts) In the CommBank app: Log on to the CommBank app, tap the top left menu then ATM Deposit Codes; In NetBank: Log on to NetBank and click Transfers & BPAY then ATM Deposit Codes; In CommBiz: Log on to CommBiz, click Accounts then ATM Deposit Codes. What happens when I delete an ATM Deposit Code? If you delete a code in CommBiz, it’s unable to be restored. Please inform your depositor and let them know that their code will no longer work if scanned at the ATM. If you have accidentally deleted a code, a replacement code can be created.

Benefits:

| - | Affordable initial deposit and fees, including free transfer fee to Commonwealth Bank of Australia (CBA) Account through the branch of Commonwealth bank of Indonesia. |

| - | Competitive interest rate in which calculated based on end of day daily balance. |

| - | Convenient transactions in more than 180,000 Debit Prima/BCA network and more than 40,000 ATM across Indonesia. |

| |

| - | Freedom in transaction through Internet/Mobile Banking with discount for transaction fee including: |

| |

| - | Open a CBA account for the children prior to arrival in Australia. |

| - | Free withdrawal fee at CBA ATM using the Commonwealth bank of indonesia ATM card. |

| - | Free transfer fee to CBA account*. |

| - | Special AUD Exchange Rate. |

| - | Monthly statement. |

*Free transfer fee applies for customers who fulfill the minimum balance requirement of IDR 10,000,000 and AUD 1,000 within the same month of the fund transfer. This free transfer facility is not applied for transaction through branch, through Internet Banking / Mobile Banking only applied for 3x every month.

Risk of Product

The risks attached to this savings product is the change of fees and interest rates that can be done at anytime and it will be informed to customers through branches, website or other media deemed appropriate by the Bank.

Procedures and Requirements

Opening an account can be done at the nearest Commonwealth Bank branch by completing and signing the account opening application form and providing the required documents.

Document Requirement:

| For Parents | For Children |

|

|

Fees & Charges*

| Keterangan | Biaya | |

| IDR | AUD | |

| Initial deposit | IDR10.000.000,- | AUD 1.000 |

| Minimum average balance | IDR5.000.000,- | AUD 500 |

| Monthly administration | IDR5.000,- | AUD 0.5 |

| Below minimum average balance fee | IDR50.000,- | AUD 5.0 |

| Hold balance | IDR100.000,- | AUD 10 |

| Stamp duty | In accordance to the prevailing regulations. Stamp duty is charged per CIF, not per account | |

| Closing account fee | IDR50.000,- | AUD 8 |

*Fees and Charges is subject to change and it will be informed to customers through media deemed appropriate by the Bank

If you have auto debit facility on Commonwealth Bank (for example: AutoInvest, loan installment, standing instruction, standing order, etc), please ensure that your accounts have sufficient balance to cover the monthly fees and auto debit facilities.

Interest Rate Calculation

Interest is calculated based on end of day balance according to the prevailing interest rate. Interest rate table can be accessed in here

Product Expiration

The expiry of the product will be when customer or Bank closes the account.

Product Issuer

This Product issued by PT Bank Commonwealth and guaranteed by Indonesia Deposit Insurance Cooperation/Lembaga Penjamin Simpanan ('LPS')***

***If the value of total deposit exceeds maximum value/if the interest rate of deposit exceeds interest rate of Indonesia Deposit Insurance Cooperation/Lembaga Penjamin Simpanan ('LPS'), deposit is not included and/or shall not be guaranteed by LPS in Deposit Insurance Scheme/Program Penjaminan Simpanan.

Online Banking

Personal Banking

Business Banking

- Buy a Home

- Auto Loans

- Invest in Education

- Student Savings

Auto Loans

We can provide you with the money you need to buy a car quickly, at a competitive interest rate, with favourable terms and flexible repayment terms.

Apply Online for a new account now. Fast. Free. Easy!

Ready to get started with a new account with Commonwealth Bank? Click below to apply online now!

APPLY NOWWe have contributed over $20 million dollars to support the communities we serve.

We love rolling up our sleeves and helping out our neighbours.

Bahamian-owned Billion Dollar bank

established in The Bahamas

Over the past year, the continued dedication to our well entrenched business model has allowed the Bank to weather the extended and challenging economic environment while sustaining strong levels of profitability.William B. Sands, Jr. Executive Chairman, Commonwealth BankCLICK to read our Executive Chairman’s entire message

Commbank Deposit Atm Chermside

1-242-502-6200

Speak to a sales advisor about our products and services.

Commbank Deposit Atm Credit Card

Send Us a MessageCommbank Deposit Atm Frankston

Provide information to help us help you.