Certificate Of Deposit

- Best Certificate Of Deposit Rates

- Certificate Of Deposit Rates

- Certificate Of Deposit Cd

- Certificate Of Deposit Calculator

- Bank Of America Cd Account

- Certificate Of Deposit

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

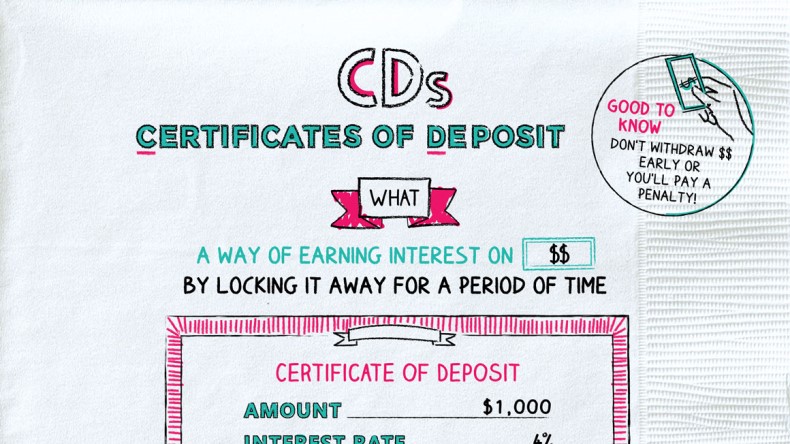

If you have savings that you don’t need for a while, a certificate of deposit could be ideal. A CD typically earns you a higher interest rate on your funds than a regular savings account — but if you need your cash early, you’ll pay a penalty.

What exactly is a certificate of deposit? A certificate of deposit, commonly called a CD, is a special savings account you can open at most banks and credit unions. But unlike a regular savings account, CDs require you to lock your funds away for a specific period of time until a maturity date. In return, you’ll get a higher interest rate.

Mar 01, 2021 Key Takeaways Top-paying certificates of deposit pay higher interest rates than the best savings and money market accounts in exchange. CDs are a safer and more conservative investment than stocks and bonds, offering lower opportunity for growth, but with. Virtually every bank, credit union,. A certificate of deposit (CD) is a savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years, and in exchange, the issuing bank pays interest. When you cash in or redeem your CD, you receive the money you originally invested plus any interest.

This unique feature makes CDs perfect as a long-term savings goal. You can typically get better interest rates than a savings account would provide without the risk of investing in the stock market.

Why you might want a CD

When I was a kid, I would save up nearly every dollar from birthdays, holidays and other income, and then I’d jump in the car with my mom to head over to the bank. As my savings grew, my dad pointed out that I might be able to get more interest from a CD, as I didn’t need the money for years.

I took my dad’s advice and opened up a few CDs with varying terms (a CD ladder). This allowed me to access a portion of my funds periodically without paying any early-withdrawal penalties.

If you have funds that you want to keep safe for anywhere from a few months to a number of years, a CD could be a good way for you to save. The early-withdrawal penalty on a CD encourages you to keep your money in the bank rather than spend it.

CD interest rates generally go up as the term increases. You’ll get a comparatively lower interest rate with most three-month CDs than with 12-month CDs, for example. Common time periods for CDs are three, six, 12, 24 or 60 months. Take care not to sign up for a CD with a maturity too far in the future. You don’t want your money tied up when you need it, especially as it’ll cost you to withdraw it early.

CD interest rates are typically lower than investment returns from the stock market, but CDs are insured up to the FDIC insurance limit — $250,000 for an individual account or $500,000 for a joint account. That’s why a certificate of deposit is a great tool for storing a down payment for a home or another far-away financial goal or purchase.

Why you might not want a CD

While a CD could be a good savings tool for many scenarios, there are a lot of reasons you may not want to put your money in a CD. It depends on your financial needs and some external market conditions.

For example, in the current interest rate environment, some high-yield savings accounts pay better interest rates than CDs. If you can earn more interest without any time requirements, you may be better off with a more traditional savings account than a CD.

You should also compare your interest rate from your CD with the current inflation rate. Some critics of CDs point out that inflation rates may rise over time to be higher than CD interest rates. In that case, you could be losing earning power by keeping your money locked in a certificate of deposit.

Perhaps the biggest downside of a CD is the early-withdrawal penalty charged if you pull your funds out before the maturity date. An early-withdrawal penalty could be a big cost, so don’t take it lightly!

What happens when you close a CD early?

If you decide you need your funds before the maturity date, you’ll pay an early-withdrawal penalty. This is usually equal to a certain number of months of interest based on the length of the CD.

Best Certificate Of Deposit Rates

Alternatives to CDs

If you like the idea of earning more than a fraction of a percent (as with an old school brick-and-mortar bank savings account), a CD might be the right choice. If a certificate of deposit doesn’t make sense for you, here are a few more ways to save at better rates without the time lock.

- High-yield savings: A high-yield savings account from an online bank may offer a compelling interest rate while giving you the freedom to withdraw at any time.

- Short-term bond fund: Bonds are a type of loan to a business or government. Short-term bonds generally offer better yields than bank accounts without the big risk of the stock market. But beware that there is some risk with any investment, including short-term bonds.

- U.S. savings bonds: If you want to put money away for a really long time, especially for a specific goal like for college, savings bonds are a secure place to store your funds. You might even be able to beat inflation with a Treasury inflation-protected security (TIPS) bond.

Certificate Of Deposit Rates

Certificate Of Deposit Cd

Bottom line

Certificate Of Deposit Calculator

Certificates of deposit can be a great way to save money in some circumstances, but they are not right for everyone. But if you have cash that you want to securely store for a fixed period of time, and want to get a better interest rate than with a regular old bank account, a CD could be perfect for you.

Bank Of America Cd Account

Certificate Of Deposit